Top Grades for Texas

October 1, 2015

All Texans know that our state is a special place. And one reason it's special is our determination to do the right thing — and that includes living within our means. We're a financially conservative state that takes "pay as you go" to heart, and most Texans seem just fine with that.

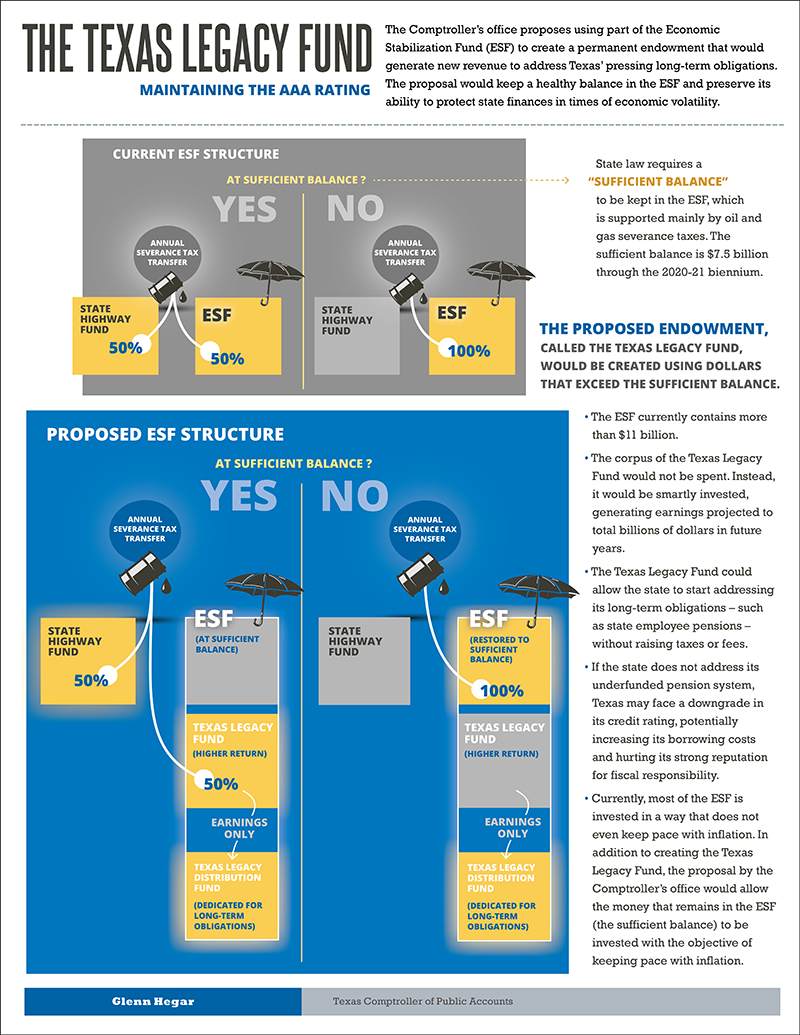

I'm pleased to report that the major credit rating agencies have just acknowledged the success of our approach. Our state's long-term general obligation debt was once again assigned the highest possible credit ratings from Moody's (Aaa), Standard and Poor's (AAA) and Fitch (AAA), with stable outlooks from all.

Credit ratings are important because they affect the cost of borrowing — high credit ratings translate into lower costs for taxpayers. Texas' ratings are due to its diverse economy, which has sustained economic growth despite falling oil prices; our state government's ample reserves and liquidity; and the Legislature's consistent focus on protecting our finances.

Of course, Texas still faces significant challenges. All three rating agencies noted the state's growing demands for public education, transportation and healthcare. And while the Legislature took action in both 2013 and 2015 to address funding for employee pensions, the agencies continue to see our pension liabilities as a potential trouble spot.

We need to stay vigilant to make sure we address our long-term financial challenges and keep Texas strong and prosperous.

As always, let us know how we're doing via our customer service website, Twitter or Facebook.

Thank you for all you do for Texas, and God bless,

Glenn Hegar