What is a Tirz?Chapter 311

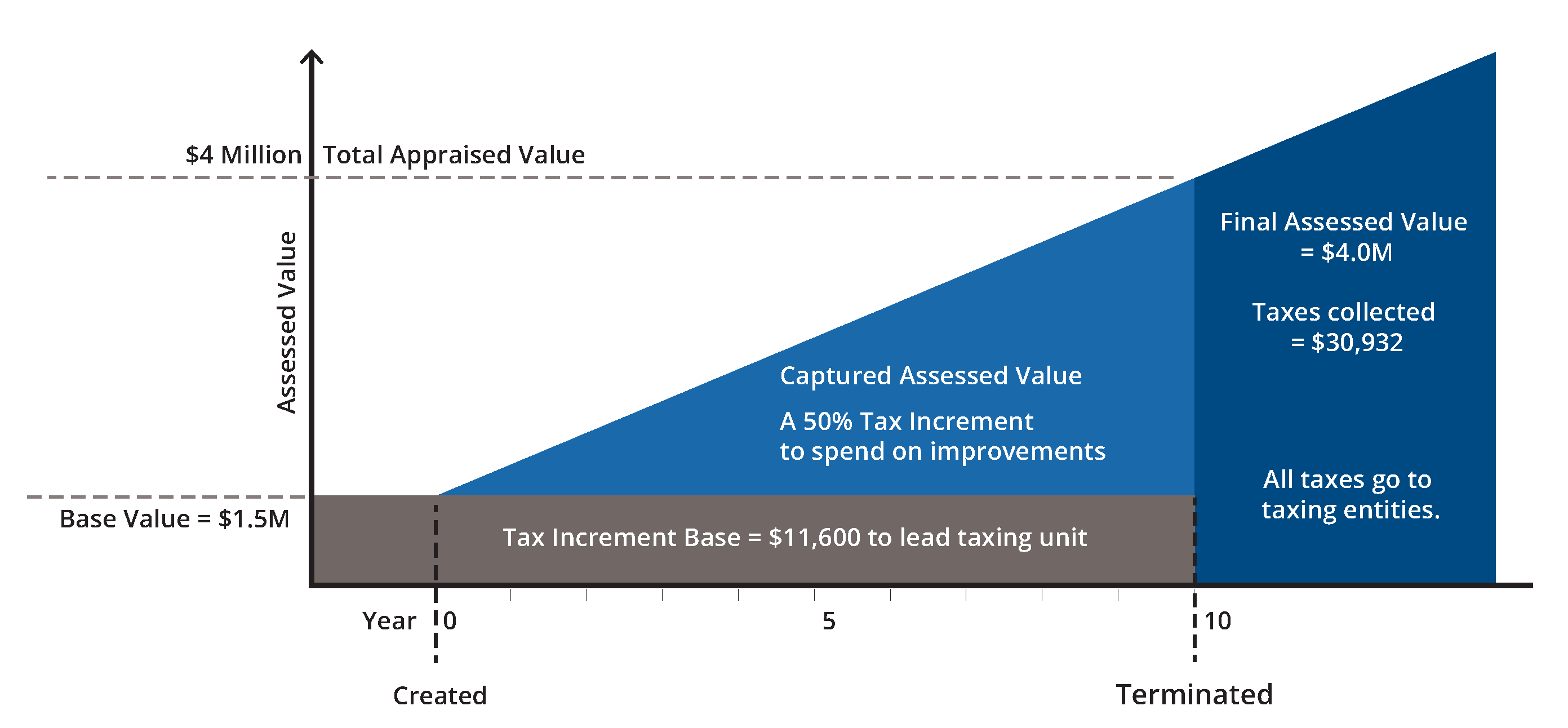

When a municipality or county creates a Tax Increment Reinvestment Zone (TIRZ), it records all taxable value of property within the zone.

The year a TIRZ is created is the base year. The appraised value of property within the zone during the base year is the base value.

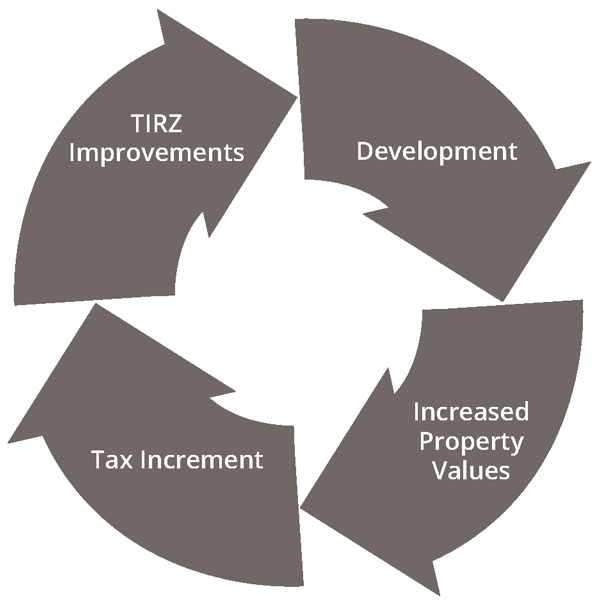

As development or redevelopment occurs, the appraised value of the property in the zone should increase. The difference between the increased appraised value of property in the zone and the base value is the captured appraised value.

Current Appraised Value - Base Value = Captured Appraised Value

Taxes levied and collected on the base value remain with the participating taxing units.

The portion of the taxes collected on the captured appraised value, or tax increment, is deposited in a Tax Increment Fund (TIF). Revenues in the TIF can only be used for improvement projects in the TIRZ.

The duration of the TIRZ is set when it is created. When the TIRZ ends, all taxes from the zone go to the taxing units in the zone.

TIRZ Math Examples

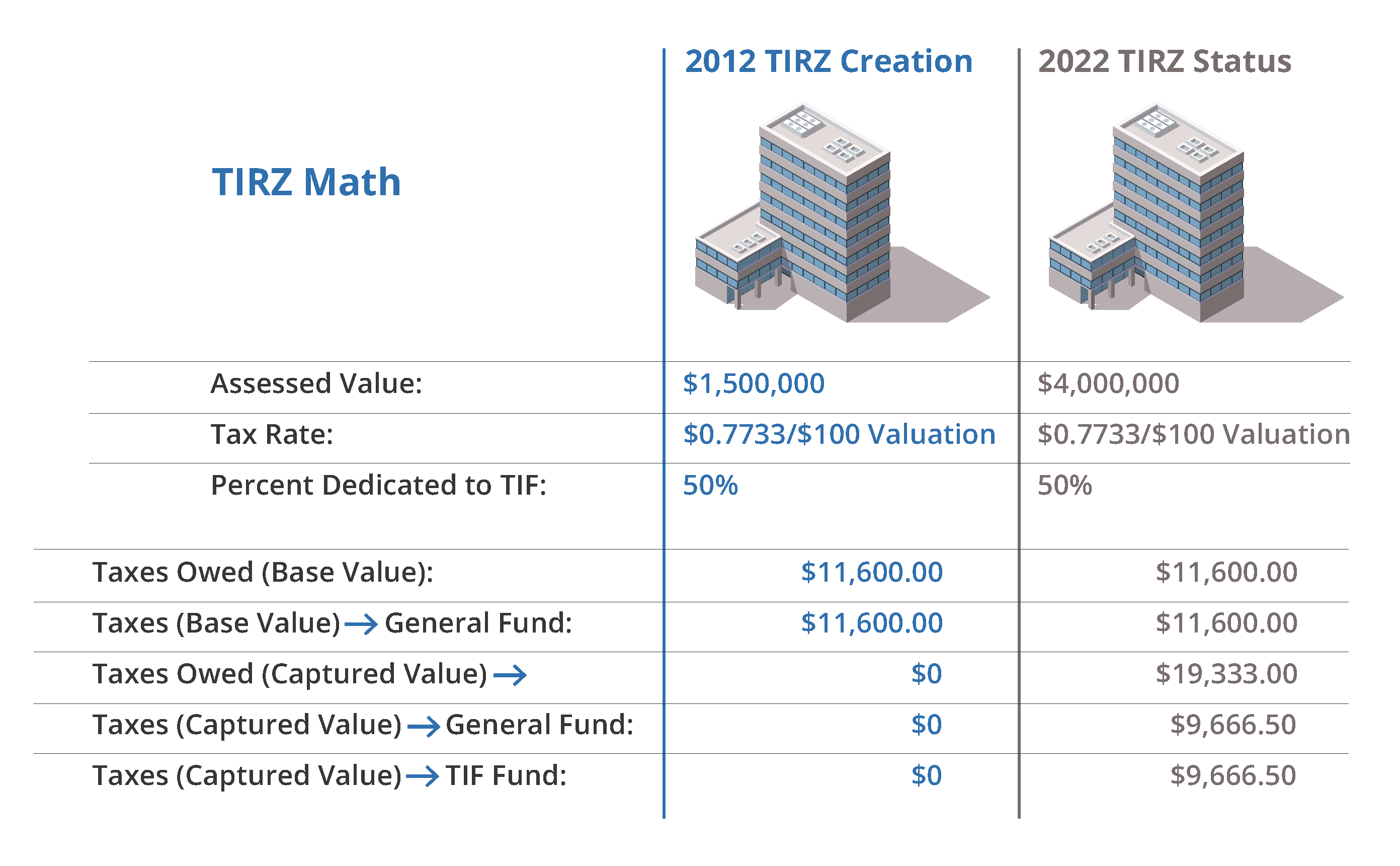

A city creates a TIRZ with the tax increment base of $1.5 million and approves an ordinance to dedicate 50 percent of the taxes above the tax increment base into the TIF for 10 years. The city’s tax rate is 0.7733 percent.

With a tax rate of 0.7733 percent, and an appraised value of $1.5 million, the base value, or taxes owed, is $11,600. This is captured by the city and moved into its general fund.

After 10 years, the appraised value of the TIRZ is $4 million.

The base value is still $1.5 million. The tax increment base is $11,600, and that money goes to the general fund.

The remaining $2.5 million is the captured appraised value. The incremental taxes owed, or captured appraised dollars, on the zone is $19,333.

Because the city dedicated 50 percent of its captured appraised dollars for the TIF, $9,666.50 will go into that fund. The other half of the captured appraised dollars will go to the city’s general revenue account.

In subsequent years, all taxes collected from the zone will go to the city’s general fund.

TIRZ Process and Implementation

To establish and implement a Tax Increment Reinvestment Zone (TIRZ), a local taxing unit needs to follow these steps.

TIRZs and Tax Collections, Remitting & Processing Timeline

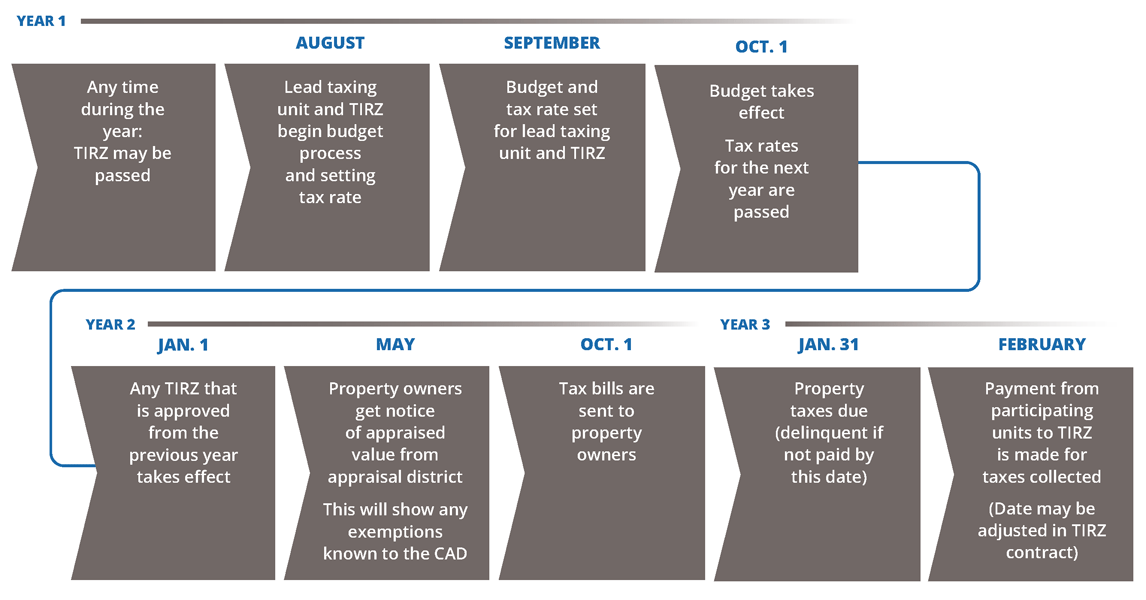

A Tax Increment Reinvestment Zone (TIRZ) is created after the governing body approves the zone boundaries and the portion of the tax increment earmarked for a Tax Increment Fund (TIF).

The next step is when the TIRZ board and the local government begin their budget processes and hold hearings to set the tax rate for the next fiscal year. The TIRZ board must get the local taxing unit’s approval for its budget. After the local government approves the budget, and the approved tax rates take effect.

The approved TIRZ will take effect Jan. 1 of the following year.

In May property owners should get a notice from the appraisal district of their property’s appraised value. This notice will show any exemptions on the property reported to the appraisal district from the local taxing unit. Failure to report this information to the CAD in a timely manner can impact the abatement agreement’s implementation.

Tax bills are sent to all property owners in October, including those within the TIRZ.

Taxes within the boundaries of a TIRZ may increase or decrease based on the tax rate set and property valuations determined by the appraisal district. Property taxes on the business will be due Jan. 31.

Being within a TIRZ has no effect on the tax rate, regardless of the approved tax increment. But because public project improvements are made within the zone, property values may increase, potentially increasing a property owner’s tax bill. The tax increment captured and remitted to the TIF goes for zone improvements, rather than the lead taxing unit’s general revenue budget.

In February, the taxes that are collected are remitted to the local taxing units, including the TIRZ.

TIRZ Fund Remittances Timeline

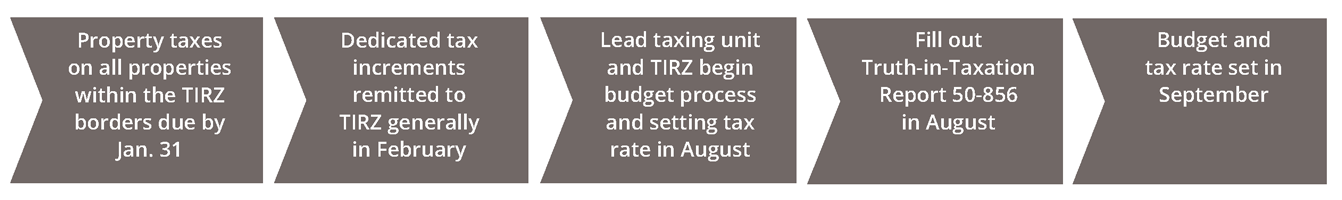

First, a taxing unit creates a TIRZ at some point before Jan. 31. All property taxes on properties with the boundaries of a TIRZ are due by Jan. 31.

Taxes are collected, and the dedicated tax increments are remitted to the TIRZ in February.

Taxes are collected, and the dedicated tax increments are remitted to the TIRZ in February.

The lead taxing unit creates their budget and sets their tax rate in August.

In August, the local taxing unit must fill out Truth-in-Taxation form 50-856. Use Form 50-856, Tax Rate Calculation Worksheet for Taxing Units Other Than School Districts or Water Districts (PDF)

Approval of the budget and local tax rate are completed in September to prepare for a fiscal year beginning Oct. 1.

TIRZ Financing and Funding Process

A TIRZ board enters into an agreement with a private developer for projects within the zone. The developer agrees pay the cost of construction of a particular improvement. The board agrees to reimburse the developer for the project costs when funds become available. Thus, the financial risk shifts from the TIRZ to the developer.

These early improvements encourage the development of the zone by increasing the appraised value of property. This generates increased tax increments from each property within the boundaries, which are forwarded to the TIF. In some cases, this money can be used to reimburse the developer. Consult legal counsel for details.

This increased revenue may be sufficient to pay for improvements within the TIRZ in subsequent years, without incurring any additional debt.

Need Help?

For additional information, contact the Data Analysis and Transparency Division via email or at 844-519-5672.