Property Tax Today

Quarterly Property Tax News

Volume 2 | Oct 1, 2017

Property Tax Today features information regarding upcoming deadlines, action items and information releases.

We would like to hear from you regarding information you would like to see in future editions. Please send property tax questions and/or suggested topics to ptad.today@cpa.texas.gov. We will gladly address property tax matters under our authority.

Message from the Comptroller

Glenn Hegar

Texas Comptroller

Our hearts go out to those affected by Hurricane Harvey and we continue to offer our prayers of sympathy and support in the wake of this disaster.

The Comptroller's Office is playing a key role in the overall state response, focusing primarily on ensuring resources are available for rescue and recovery efforts and offering technical assistance on property tax matters in disaster areas as our communities and neighborhoods begin rebuilding. Contact the Property Tax Assistance Division's (PTAD) Information Services Team for information on available options. We will continue to assist in any way we can.

Prior to Harvey, the Property Tax Assistance Division (PTAD) had an extremely active few months. Not only did PTAD employees actively participate in the 85th Regular Session and First Called Session, but the Truth-in-Taxation (TNT) forms and web pages were reformatted, the Property Value Study (PVS) results were certified to the Commissioner of Education in August, and draft questions and guidelines were developed for the 2018-19 Methods and Assistance Program (MAP) review cycle.

As we move away from the legislative session and head toward the holidays, PTAD will gear up for the 2017 PVS and the 2018-19 MAP reviews. In addition to performing our mandated duties, we will be working through challenges Harvey's recovery will pose as well as implementing new mandates and changes that arose out of the 85th Regular Session. The property tax information offered by our office is extensive, and PTAD actively works to update forms, publications, videos and web pages as quickly as possible. Please remember to always check PTAD's website for the most current versions of published information and forms.

The 2017 Tax Code and 2017 Property Tax Laws books will soon be available for sale. You will be able to place an order by forwarding an order form and required payment to PTAD. The 2017 Law Changes will be published soon. It summarizes property tax laws that changed as a result of legislation passed during the 85th Regular Session. Remember to attend the Property Tax Institute in Austin, Dec. 5-6, to learn about some of these changes!

Thank you and God Bless Texas.

2017 State Laws and Rules Update

Property tax professionals registered with the Texas Department of Licensing and Regulation (TDLR) must take a state-required laws and rules update to meet continuing education requirements. These programs require special approval as they cover specific bills passed by the 85th Legislature.

Continuing education programs do not require an approved instructor. You may contact us at PTP.Edu@cpa.texas.gov if you are interested in learning more about developing continuing education programs for your staff or for your clients.

2016 Final PVS Results

On Aug. 15, 2017, the Comptroller's office certified the total value of all taxable property in each school district to the Commissioner of Education as required by Government Code Chapter 403. The 2016 PVS final taxable value findings are available on PTAD's Property Value Study and Self Reports web page.

On Aug. 15, 2017, the Comptroller's office certified the total value of all taxable property in each school district to the Commissioner of Education as required by Government Code Chapter 403. The 2016 PVS final taxable value findings are available on PTAD's Property Value Study and Self Reports web page.

The 2016 PVS final findings indicate 1,515 of the school districts studied received local value, and only 40 received state value.

Grace Period Applicability

Eligible school districts with invalid PVS findings may qualify for a two-year grace period to have local property values reported to the Texas Education Agency. An invalid finding occurs when a school district's local value falls outside a certain range of the Comptroller's determined value in the PVS.

Prior to 2016, PTAD interpreted Government Code sections 403.3011 and 403.302(l) to mean that the eligibility criteria must be met in both Year 1 and Year 2 of the grace period. As a result, a school district could be eligible for grace in Year 1 but not qualify for grace in Year 2.

An inquiry about Paint Rock Independent School District's 2015 PVS findings prompted PTAD to reevaluate the statute and the underlying legislative intent behind the application of the grace period. PTAD determined that the eligibility criteria should be applied to Year 1 but not to Year 2. As a result, a school district that is eligible for grace in Year 1 will qualify for grace in Year 2 automatically when the local value is invalid.

This change would not and will not impact many school districts, but does align PTAD's interpretation with the statutory language and legislative intent of the grace period. The Comptroller's office offers further information on the PVS and the grace period in its Property Value Study and How to Protest (PDF) publication.

Notes from the Field

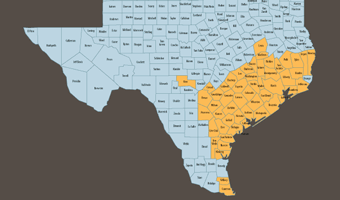

In response to Hurricane Harvey, Governor Greg Abbott declared the following counties as disaster areas:

Angelina, Aransas, Atascosa, Austin, Bastrop, Bee, Bexar, Brazoria, Brazos, Burleson, Caldwell, Calhoun, Cameron, Chambers, Colorado, Comal, DeWitt, Fayette, Fort Bend, Galveston, Goliad, Gonzales, Grimes, Guadalupe, Hardin, Harris, Jackson, Jasper, Jefferson, Jim Wells, Karnes, Kerr, Kleberg, Lavaca, Lee, Leon, Liberty, Live Oak, Madison, Matagorda, Milam, Montgomery, Newton, Nueces, Orange, Polk, Refugio, Sabine, San Augustine, San Jacinto, San Patricio, Trinity, Tyler, Victoria, Walker, Waller, Washington, Wharton, Willacy and Wilson

When requested by a local taxing unit, an appraisal district is required to complete a reappraisal as soon as practicable of all property damaged in an area that the governor declares a disaster area. The local taxing unit requesting the reappraisal must pay all the costs involved. If more than one taxing unit requests the reappraisal, all requesting taxing units share the costs based on the proportion of taxes imposed in the affected locality in the preceding year.

When requested by a local taxing unit, an appraisal district is required to complete a reappraisal as soon as practicable of all property damaged in an area that the governor declares a disaster area. The local taxing unit requesting the reappraisal must pay all the costs involved. If more than one taxing unit requests the reappraisal, all requesting taxing units share the costs based on the proportion of taxes imposed in the affected locality in the preceding year.

For reappraised property, the taxes are prorated for the year the disaster occurred. The local taxing unit assesses taxes prior to the date the disaster occurred based on the market value as of Jan. 1. Beginning on the date of the disaster and for the remainder of the year, the taxing unit applies its tax rate to the reappraised market value of the property.

PTAD will be reaching out to appraisal districts in governor-declared disaster counties to gather information regarding taxing units that authorized reappraisals and local property value impact estimates.

If a school district needs to increase expenditures because of a disaster (including a tornado, hurricane, flood or other calamity) and the governor has requested federal disaster assistance for the school district's area, the tax rate for the tax year after the disaster is not subject to a ratification election under Tax Code Section 26.08 to approve the rate.

More information regarding property taxes in disaster areas, including reappraising property, application of exemptions and tax limitations, installment payment options and waivers of penalty and interest, can be found on PTAD's web page.

Truth-in-Taxation

We are pleased to announce the reorganization of our TNT web pages with the posting of 2017 TNT information. To provide easier use, the TNT information is consolidated into five pages: overview, tax rate calculations, notice requirements, hearing requirements and rollback elections.

We are pleased to announce the reorganization of our TNT web pages with the posting of 2017 TNT information. To provide easier use, the TNT information is consolidated into five pages: overview, tax rate calculations, notice requirements, hearing requirements and rollback elections.

The tax rate calculation forms were also reorganized and consolidated into three fillable forms:

- 50-859, Sample Tax Rate Calculation Worksheet for School Districts (PDF)

- 50-858, Sample Water District Rollback Tax Rate Worksheet (PDF)

- 50-856, Sample Tax Rate Calculation Worksheet for Taxing Units Other Than School Districts or Water Districts (PDF)

PTAD continues to provide videos with comprehensive information for taxing units regarding setting tax rates and their legal responsibilities to taxpayers. These videos can be found on the Property Tax Videos web page and allow continuing education credit for registrants with TDLR.

Binding Arbitration Changes

The 85th Legislature made the following changes to binding arbitration laws effective Sept. 1, 2017.

- Senate Bill 731 raised the value of non-homestead property that is eligible to go to binding arbitration from a limit of $3 million up to a limit of $5 million.

- Senate Bill 1286 changed the selection process for arbitrators from property owner and appraisal district selection to Comptroller selection and restricted arbitrator eligibility.

- Senate Bill 1286 limits arbitration assignment to arbitrators living in the county of the arbitration and only opens an arbitration to statewide selection when a county does not have any residing arbitrators living in the county or when all residing arbitrators have declined a case.

- Senate Bill 1286 prevents arbitrators from being eligible for an appointment if, at any time during the preceding five years, they have represented a person for compensation in a Tax Code proceeding or have served as an officer or employee of the appraisal district or member of the appraisal review board (ARB) in the county in which the subject property is located.

Arbitrations received prior to Sept. 1, 2017, are subject to the arbitration requirements and selection and assignment process in place prior to that date. Comptroller Rule 9.804 on binding arbitration is in the process of being updated to reflect these new statutory changes.

Property Tax Institute

The 2017 Property Tax Institute Conference will be held at the Commons Learning Center in Austin on Dec. 5-6. PTAD co-hosts this annual conference with the University of Texas-Austin, Lyndon B. Johnson School of Public Affairs.

The 2017 Property Tax Institute Conference will be held at the Commons Learning Center in Austin on Dec. 5-6. PTAD co-hosts this annual conference with the University of Texas-Austin, Lyndon B. Johnson School of Public Affairs.

The agenda will cover topics of interest to appraisal districts and tax offices. To register, please visit the website for the co-sponsor of the institute. Information about directions and hotel accommodations is also available on the website. Questions about the conference should be directed to the staff of the Texas LBJ School at 512-471-0820.

New EARS System Coming Soon!

PTAD collects appraisal roll data from each appraisal district annually through the Electronic Appraisal Roll Submission (EARS) system.

The EARS data file is currently submitted in a format that is a fixed-field-width text file, such as a fixed 11-digit number, with six different record types. This combination of record types and data format creates a large and cumbersome file.

PTAD is designing a new EARS data system to consist of only three types of records and is changing the file format to a comma-separated values (CSV) format, which should reduce the file size and make data more manageable.

PTAD intends to work with the appraisal districts and the software vendors to implement these changes in 2019. We expect to have a draft copy of the EARS manual indicating the proposed revisions available for review and comments by our software committee and chief appraisers in November 2017. Stay tuned!

Operations Survey Data

The responses to the Appraisal District Operations Survey for the 2016 Tax Year are now available on PTAD's Property Tax Surveys and Reports web page.

Methods and Assistance Program

For the 2018-19 MAP review cycle, all chief appraisers have the opportunity to review the draft questions and guidelines and provide feedback by Oct. 18, 2017. All written comments will be considered, appropriate changes will be made and the final 2018-19 questions will be posted on PTAD's Methods and Assistance Program web page.

Upon finalization of the 2018-19 MAP documents, notice will be sent to appraisal districts that are scheduled to receive a MAP review in 2018, together with the request for data.

For the 2016-17 MAP review cycle, the preliminary 2017 MAP reports were released Sept. 14, 2017. All remaining data from appraisal districts for their final 2017 MAP reports is due Nov. 1, 2017.

Indigent Health Care

Health and Safety Code sections 61.040 and 61.041 require counties that participate in an indigent health care program to complete Comptroller Form 50-252 (PDF).

The person who is authorized to complete this form should sign it and include title, phone number and date signed. The fully executed form should be sent to PTAD at the address on the form by Nov. 15, 2017.

If you need help in completing this form, call Information Services at 800-252-9121 (press 2 to access the menu, then press 1 to contact the Information Services Team).

Appraisal Review Board Surveys, Comments and Suggestions

The Comptroller's office is preparing the annual report summarizing property owners' comments and suggestions about ARBs received through our survey. Because surveys can only be submitted electronically, information from any handwritten surveys completed at the appraisal district office must be entered into the electronic survey no later than Dec. 1, 2017.

Additionally, taxpayer liaison officers in counties with populations exceeding 120,000 (as defined by the 2010 U.S. Census) must submit to the Comptroller's office a list of verbatim comments and suggestions received from property owners, agents or chief appraisers about the model ARB hearing procedures or any other matter related to the fairness and efficiency of the ARB. Please submit comments and suggestions received pertaining to these matters only in the appropriate Excel spreadsheet template to Kara Kelly no later than Dec. 31, 2017.

Chief Appraiser Eligibility

All chief appraisers must notify the Comptroller's office in writing no later than Jan. 1 of each year whether they are eligible to be appointed or serve as chief appraiser. Written notification must be submitted using Comptroller Form 50-820, Tax Code Section 6.05(c) Notification of Eligibility or Ineligibility to be Appointed or Serve as Chief Appraiser (PDF). Executed forms should be sent to PTAD by email to ptad.cpa@cpa.texas.gov or by hand delivery, courier or U.S. first class or certified mail to Property Tax Assistance Division, 1711 San Jacinto, 3rd Floor, Austin, Texas 78701.

Tax Bills

Taxing units usually mail their tax bills in October. Tax bills are due upon receipt, and the deadline to pay taxes usually is Jan. 31. Taxes become delinquent and penalty and interest charges are added to the original amount beginning on Feb. 1. Failure to receive a tax bill does not affect the validity of the tax, penalty or interest due, the delinquency date, the existence of a tax lien or any procedure the taxing unit institutes to collect the tax.

More information regarding payment of taxes, including deadlines, consequences for failure to pay and instances when a waiver of penalty or interest may apply, can be found on PTAD's Paying Your Taxes web page.

Information regarding payment options can be found on PTAD's Payment Options web page. Tax collection offices are required to offer certain, but not all, payment options. The local tax collection office should be contacted to determine what local payment options may be available.

Proposed Constitutional Amendments

On Nov. 7, 2017, Texas voters will decide whether to approve the following:

- A property tax exemption of part of the market value of the residence homestead of a partially disabled veteran or the surviving spouse of a partially disabled veteran if the residence homestead was donated to the disabled veteran by a charitable organization for less than its market value.

- A property tax exemption of all or part of the market value of the residence homestead of the surviving spouse of a first responder who is killed or fatally injured in the line of duty.

- A lower amount for expenses that can be charged to a borrower and removing certain financing expense limitations for a home equity loan, establishing certain authorized lenders to make a home equity loan, changing certain options for the refinancing of home equity loans, changing the threshold for an advance of a home equity line of credit and allowing home equity loans on agricultural homesteads.

For more information on proposed constitutional amendments, please refer to the Texas Secretary of State's website.

Attorney General Opinions

The following opinions were issued by the Office of the Attorney General.

Opinion No. KP-0165 (Sept. 12, 2017)

Local Government Code section 192.001 requires a county clerk to record an instrument that is required or permitted by law to be recorded. Thus, a county clerk may not refuse to accept for filing an instrument concerning real property, including an affidavit of adverse possession, if the affidavit meets the recording requirements of Property Code section 12.001(a). Fraudulent affidavits are criminal, and county clerks have a duty to notify property owners when a fraudulent affidavit is filed.

Opinion No. KP-0157 (Aug. 3, 2017)

Government Code Section 573.041 prohibits a public official from appointing certain relatives to positions compensated with public funds. The reimbursement of expenses, however, is not compensation. Thus, a public official may appoint a close relative to a volunteer position that provides reimbursement for incurred expenses but no compensation.

Opinion No. KP-0154 (July 14, 2017)

Tax Code Section 26.08(a) requires the registered voters of an independent school district to approve an adopted tax rate if the governing body of the district adopts a tax rate that exceeds the district's rollback tax rate. The rollback rate calculation, defined in Tax Code Section 26.08(n), includes a maximum maintenance and operations (M&O) tax rate component and a current debt service tax rate component. The debt service component of the rollback rate does not reflect the debt service tax rate of the preceding year but of the current year. As a result, the rollback tax rate effectively measures only the M&O component of the tax rate.

An independent school district may not increase an M&O tax rate above the maximum M&O tax rate component calculated for purposes of the rollback tax rate without voter approval through a tax ratification election.

Opinion No. KP-0147 (May 11, 2017)

A court would likely construe Tax Code Section 11.13(l)(2)(B) to refer to an owner's temporary residence in an establishment set up to assist persons with overcoming illness or injury, or with needs related to physical or mental weakness or growing old, through a wide range of activities, regardless of whether the owner receives such services.

Action Items

Below is a list of action items for the fourth quarter of 2017. A full list of important property tax law deadlines for appraisal districts, taxing units and property owners can be found on PTAD's website.

- Oct. 16 - Farm and Ranch Survey responses due

- Oct. 18 - Feedback on draft 2018-19 MAP documents due

- Nov. 1 - Final MAP documents for 2017 reports due

- Nov. 15 - Indigent health care forms due

- Dec. 1 - ARB survey comments due

- Dec. 31 - Taxpayer liaison officer comments received due

- Jan. 1 - Chief appraiser eligibility forms due

If the last day for one of the deadlines is on Saturday, Sunday or a legal or state holiday, the act is timely if performed on the next regular business day.

Please be advised that the information in this newsletter is current as of the date of its publication and is provided solely as an informational resource. The information provided neither constitutes nor serves as a substitute for legal advice. Questions regarding the meaning or interpretation of any information included or referenced herein should be directed to legal counsel and not to the Comptroller's staff.